The Federal Reserve loaned $1.5 trillion to the financial system yesterday– $500 billion into short-term bank funding — and misguided critics believe the Fed exchanging cash for securities to increase liquidity and prevent a bank run is a government “bailout” and tantamount to “corporate welfare.” However, monetary policy is completely independent of fiscal policy (the kind used in ‘08), and an exchange of bonds for cash to increase banks’ needed liquidity amid a pandemic that can lead to a bank run is not a “bailout.”

The first part of the plan will involve extending purchases across a range of maturities and the second part will offer $500 billion in a three-month repo operation and a one-month operation. Additionally, the Fed will continue offering $175 billion in overnight repost and $45 billion in two-week operations.This comes from fear over a global recession as government bond yields cascaded to record lows earlier this week.

On the other hand, the 2008 government bank bailout (Emergency Economic Stabilization Act of 2008), was a fiscal policy action where actual value was created that actually cost tax-payers. The treasury department gave banks $700 billion in exchange for mortgage-backed securities that were in danger of defaulting.

The Fed isn’t handing out money to anyone though. No new value was transferred, liquidity was just increased.It’s $1.5 trillion in cash being loaned to banks to help stabilize markets in return for $1.5 trillion in bonds from the repo market. Banks will return the cash and get their bonds back.

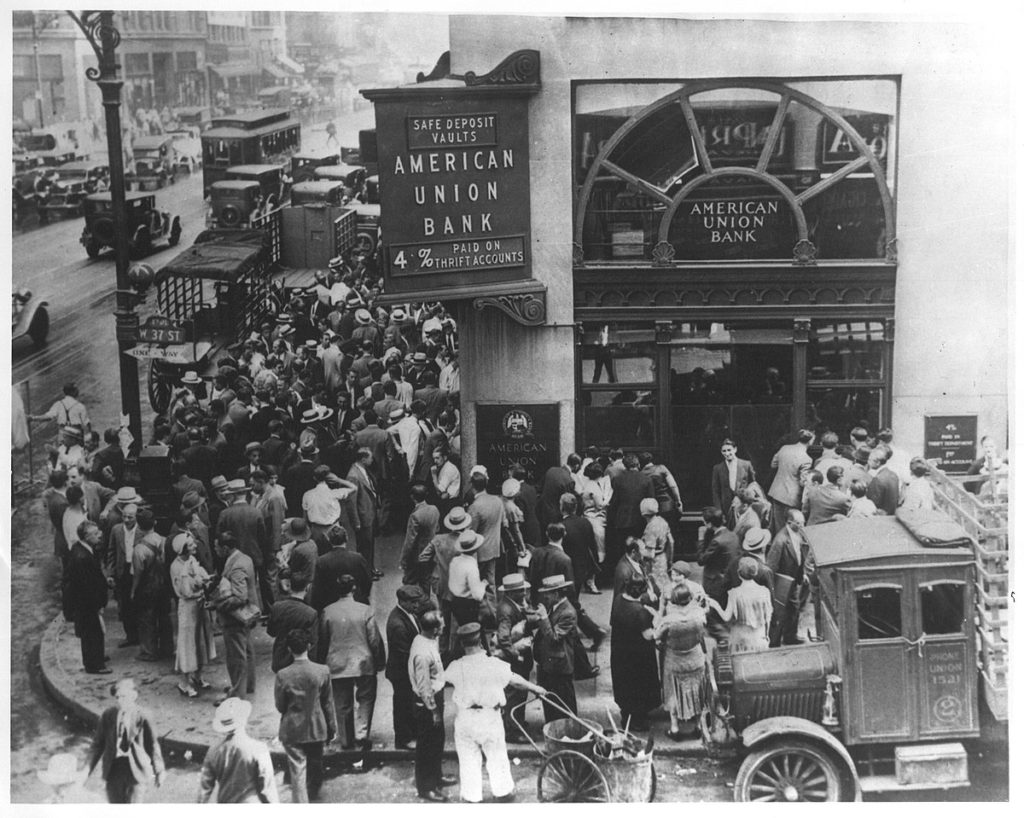

Why was this necessary? Banks have a required reserve ratio — a fraction of deposits that must be held as reserves. During times of economic panic, the Fed steps in to increase bank liquidity so they can remain solvent if a large number of people decide to mass withdraw money during a ‘bank run.’ Banks need to be prepared in this scenario and need liquid cash for other purposes. For this reason, the repo market exists. In the repo market, financial institutions and the Fed swap less liquid assets like bonds in exchange for cash. This happens daily so banks can meet their reserve requirements. There is no transfer of value — just exchange of liquidity. The Fed buys bonds in the repo market and provides banks with the cash (liquidity) they need. Banks will buy back their bonds in a matter of days or weeks.

If the Fed doesn’t step in to increase liquidity, banks can run out of cash and mass panic will ensue as a bank run occurs. The Fed steps in to prevent a banking system collapse from people withdrawing all their money.

Leave a Reply