Mass hunger, unemployment, sickness, and an eviction crisis are things Americans are experiencing at a level not seen since the Great Depression through no fault of their own and with no relief. The other America, the billionaire class’ wealth has seen their wealth surpass a $1.9 trillion gain since mid-March, 2020 when most federal and state economic restrictions responding to the virus were in place. While over 70 million Americans filed for unemployment (40% of the labor force), evictions rose, and food banks ran out of food, 660 billionaires saw their wealth rise 40% to $4.1 trillion 10 months into the pandemic and Wall Street minted 56 new billionaires. This amount is two-thirds higher than the $2.4 trillion in total wealth held by the bottom half of the population of 165 million. The pandemic has exacerbated the nation’s economic inequality.

Recession by The Numbers: U.S. Job Losses

Regular Americans have not fared as well as billionaires during the pandemic: The pandemic hit the airlines ($34B in losses), restaurants ($240B in losses), hotels, and mall-based retailers the hardest while industries like tech boomed. The unemployment rate stood at 6.7% beginning January. Over 25 million have fallen ill with the virus and more than 420,000 have died from it. [Johns Hopkins Coronavirus Resource Center]. Over 73 million lost work between Mar. 21 and Dec. 26, 2020. [S. Department of Labor]. 16 million were collecting unemployment on Jan. 2, 2021. [S. Department of Labor]. Nearly 100,000 businesses have permanently closed. [Yelp/CNBC]. 12 million workers have likely lost employer-sponsored health insurance during the pandemic as of August 26, 2020. [Economic Policy Institute]. 14 million adults—1 in 5 renters—reported in December being behind in their rent. [CBPP].

Employment for t those making less than $27,000 a year remains over 20% below January 2020 levels. Last month, 29 million adults lacked sufficient foodt, according to the U.S. Census Bureau’s Household Pulse Survey, up 28% since before the pandemic. From Nov. 25-Dec. 7, between 8 -12 million children lacked food [Center on Budget & Policy Priorities (CBPP)]. Over a third of U.S. adults who have fallen behind on rent or mortgage payments are likely to face eviction or foreclosure over the next two months, per the December Census Bureau survey.

This economic inequality also exists among racial, ethnic, and gender gaps. Low-wage workers, people of color and women have suffered disproportionately in the combined medical and economic crises of 2020. Latinos are more likely to become infected with Covid-19 and Blacks to die from the disease than are white people. While the Labor Department showed that all of the job losses in December were positions previously held by women

Billionaire Wealth and Pandemic Profiteers

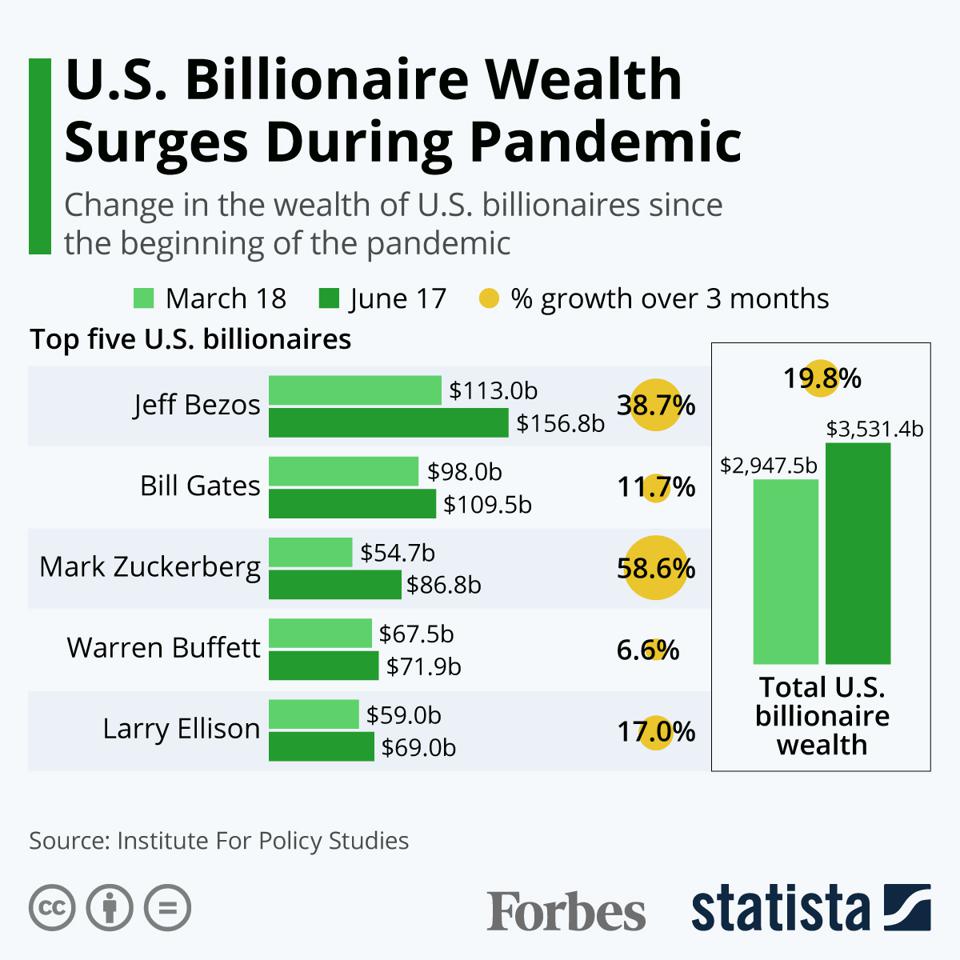

Polar opposite to this, the one-percent’s wealth soared to the tune of $1.9 trillion and the US gained 56 new billionaires between mid-March and Dec. 22 per a December report from the Institute for Policy Studies. America’s 659 billionaires now hold roughly $4 trillion in wealth — roughly double what the 165 million poorest Americans are collectively worth. The 10 richest billionaires have a combined net worth of more than $1 trillion.

Some of the biggest winners during this pandemic have been companies like Amazon, who’s profit increased by about 70% to $14.1 billion while they exploit their workers. Jeff Bozeos, Elon Musk,and Bill Gates were each worth more than $100 billion on Jan. 18. Elon Musk’s wealth grew by over $154 billion, from $24.6 billion on March 18 to $179.2 billion on Jan. 18. Jeff Bezos’s wealth grew from $113 billion on March 18 to $182 billion, an increase of 61%. Mark Zuckerberg’s wealth grew from $54.7 billion on March 18 to $92 billion, an increase of over two-thirds

It’s difficult to fathom such massive wealth gains concentrated at the top while workers are suffering during a pandemic-induced world economic collapse marked by an increased surge in evictions, over 465,000 COVID deaths, 6.7% unemployment, and a 28% increase in hunger. But the top 20% of earners have not had to worry about these issues as they carry out their jobs from home, gain from the Fed’s 0% rates, refinancing mortgages at record low rates, and watch the value of their stocks, bonds, and investment accounts surge. Those whose wealth is captured by financial assets have benefited during an economic collapse.

Tax Reform

This $1.9 trillion wealth gain by 660 U.S. billionaires is large enough to pay for all the relief for working families in President Biden’s proposed $1.9 trillion pandemic rescue package which includes $1,400 in direct payments to individuals, $400-a-week supplements to unemployment benefits, and an expanded child tax credit. A stimulus check of more than $3,400 for every one of the roughly 331 million people in the United States.

There is no reason why workers should be struggling while billionaire CEOs amass trillions of dollars in wealth built by workers. This is why tax reform is necessary. Biden’s promising tax plan wants to deliver on this by transforming parts of billionaire gains into public revenue to help the nation. But this still falls short of structural change to how wealth is taxed.

Moody’s Analytics, “The Biden Fiscal Rescue Package,” Jan. 15, 2021

Forbes, “Forbes Publishes 34th Annual List Of Global Billionaires,” March 18, 2020.

The best approach is an annual wealth tax on the top 0.1% of households like the tax plan proposed by Senator Bernie Sanders among others. Taxing those worth over $32 million only will “raise an estimated $4.35 trillion over the next decade and cut the wealth of billionaires in half over 15 years, which would substantially break up the concentration of wealth and power of this small privileged class.”

Another solution is the taxation of annual investment gains on tradable assets as advocated by Senate Finance Committee chair, Ron Wyden.

Economic Inequality Is Institutional Robbery

Over the last 30 years, the top 1 percent has seen a $21 trillion increase in its wealth, while the bottom half of American society has actually lost $900 billion in wealth.

Moreover, today’s $7.25 minimum wage is 29% lower than it was 50 years ago despite the fact that productivity has doubled since the late 1960s. The minimum wage would be $24.00 today if it kept up with the over 657% rise in inflation & 176% rise in productivity over the past 50 years. Hard-working Americans driving the economy through their labor are being robbed.

Leave a Reply