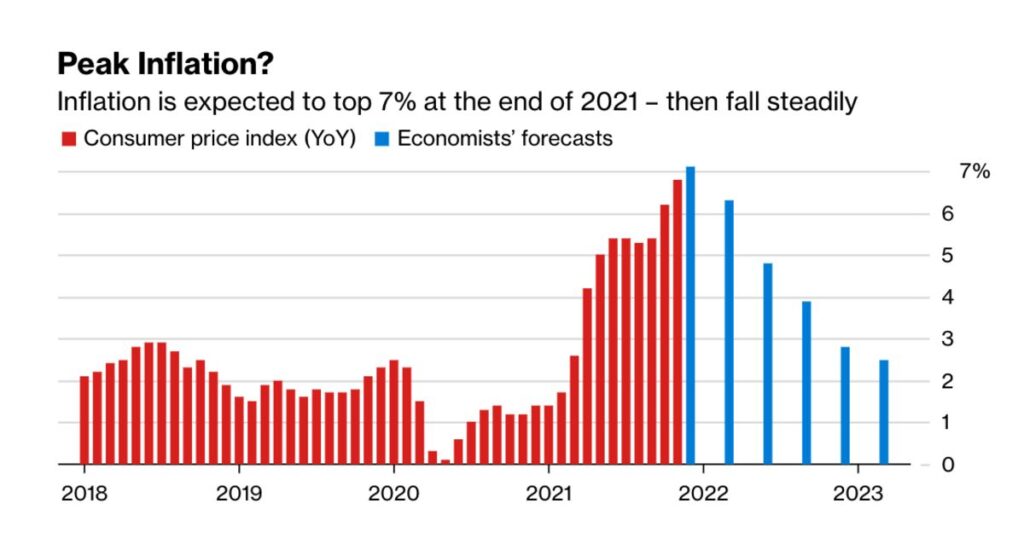

Soaring inflation rapidly climbed 7% in the United States through December, the fastest since 1982. The rising price index isn’t a unique phenomenon, it’s been seen globally. However, it’s been more pronounced in the U.S. than in any other country. Policy makers argue over the causes among partisan lines, but what has really been the driving force behind this massive inflation eating away at consumers stagnant salaries during a pandemic? Is it the general economic rebound, government spending bills, or supply shortages driving up the price level?

Inflation is a general increase in the price level and decrease in the purchasing power of money. It’s measured through the Consumer Price Index, as a change in prices for basic goods and services like food, clothing, and transportation. It can be caused by both demand-side factors like rising consumer demand and supply-side factors like supply chain shortages that we are seeing.

Economists believe 40-year high inflation has been caused by a combination of the economic rebound, government spending, and supply shortages while the Federal Reserve has kept interest rates at rock bottom. Government spending in the form of stimulus bills to help the millions of Americans who lost their jobs and faced imminent economic crisis, stimulated the economy. While many nations passed stimulus bills to boost demand, the United States’ $5 trillion in spending in 2020 and 2021 far outpaces any other country’s economic response. It boosted economic growth through consumer spending. This demand-side boost pushed the demand curve right and raised prices.

The White House holds that supply chain disruptions and shortages are responsible for the rapid increase in inflation. ““The inflation has everything to do with the supply chain,” President Biden said in a news conference. “While there are differences country by country, this is a global phenomenon and driven by these global issues,” Jen Psaki, the White House press secretary, said. It is true that supply shortages have caused inflation to be seen worldwide, in countries sfrom India to Brazil, and Europe (5 percent.) Prices also rose at a record-breaking rate in the U.K. and Canada.

The global supply chain did indeed collapse as the pandemic spread, factories shuttered, ports were backlogged, and trucking labor shortages rose. Yet amid these global supply shortages, the U.S. has experienced more rapid inflation than almost any other developed economy.

This all happening while the current Fed Funds Rate stands at 0.25%. To push both demand and supply curves to an equilibrium price level, the Federal Reserve could work to retract demand, while the government attempts to fix supply chain issues. The Fed is preparing to raise interest rates in March to make borrowing more expensive and slow spending down to ameliorate inflation. This should be effective, as many households have increased their housing and auto debt, during such low rates, thereby driving up inflation.

These actions can help rein in inflation as the U.S. economic output (real GDP) is expected to climb 4% in 2022. The inflationary buble isn’t expected to be permanent, but to remain near 7% for a few months then at more moderate levels through the rest of 2022.

Leave a Reply