Humans aren’t perfectly rational agents that make choices that maximize utility, when faced with risky choices that could lead to big gains, people are risk-averse, preferring to settle for choices that result in lower utility but higher certainty. While loss-aversion is beneficial in many situations, heuristics and personal biases cause us to miscalculate the probability of events and fear taking a risk towards a great opportunity. When we fear failure more than we want to achieve, we miss out on the good we might win if we just dared try. The only guaranteed way to fail is to not try and give up instead of strategize as every self-made person who’s succeeded at something has.

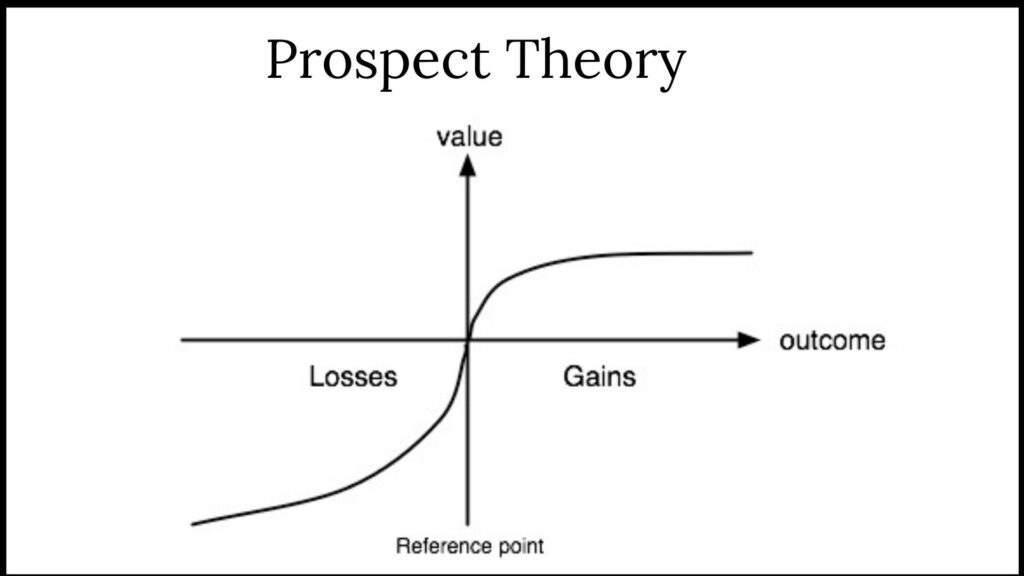

Behavioral economics reveals a lot about the science of decision making, under conditions of scarcity. Prospect theory and loss aversion describe how humans, behave when faced with risky choices and differing levels of utility (gain). Prospect theory describes how individuals make a choice between probable, risky choices. Loss aversion is a phenomenon that is a part of prospect theory (developed by Kahneman and Tversky) that describes how people make decisions based on potential gain or losses relative to their specific situation. Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. When faced with risky choices leading to gains, people are risk-averse and prefer more certain choices with lower expected utility. But when faced with risky choices leading to losses, individuals are risk-seeking, preferring solutions that lead to a lower expected utility in order to avoid losses.

Tversky and Kahneman proposed that losses cause a greater emotional impact on an individual than does an equivalent amount of gain, so they will choose the option that is most certain. For example, when faced with two options — Option 1 – $3,000 with a probability of 39%, $2,800 with a probability of 60%, and $0 with a probability of 1%, or Option 2 – a guaranteed $2,000 — humans will choose Option 2. Prospect theory and loss aversion mean that people don’t base choices based on utility overall, but probability. Individuals tend to be loss-averse as they weigh losses about twice as heavy as gains per many studies.

Prospect theory is applied anywhere from marketing to finance to national security. In finance, investors place more weight on perceived gains versus perceived losses. In international relations, theorists use it to analyze how politicians are likely to take bigger risks to avoid losses. This ties back to a “rational choice model” used in international relations, where the rational choice stems from utilitarianism — the strategic pursuit of the choice with the highest expected utility weighted by probability. The solution to this model being increased amounts and quality of information. More facts, not heuristics or biases, lead to better choices. This is why we shouldn’t act on fear, but facts.

People hate utility losses twice as much as they enjoy gains. They are more willing to take risks to avoid losses. Much like in game shows, participants in behavioral economic studies end their participation in money games when the risk of their loss is close to their effort, even when they face bigger gains by continuing. Loss aversion as a cognitive bias, is leveraged by marketing campaigns to influence consumer decisions such as through the use of free trials where buyers won’t want to give up the product or service. This is the basis of insurance — where individuals’ need for security and need to avoid big losses causes them to buy in.

A person’s risk aversion level is dependent on experiences, heuristic judgments, and biases, not often on rationality. A mixture of neurology, socioeconomic factors, and culture influence how we make decisions — with powerful and wealthier people being less loss averse. Due to their safety net and network, they assign less weight to losses than other people. The key part of prospect theory that leads humans to miss out on gains they might win due to fear, is the idea that people attribute excessive weight to events with low probabilities and insufficient weight to events with high probability. Without having enough information, acting on personal experiences and biases, individuals might choose choices they wrongly see as more probable that have a lower expected utility. This is fear and heuristics in action.

Loss aversion is the tendency to prefer avoiding losses to acquiring equivalent gains. But an overwhelming fear of financial losses can cause bad decisions — such as when investors hold stock for too long or too little amount of time. The fear of potential losses paralyzes us from trying as we overestimate risks — in the end this prevents us from taking even well-calculated risks, with great potential for returns.

What we can take away from prospect theory studies, is that humans vastly miscalculate the probability of the outcomes of certain choices and tend to focus more on the negatives — failure, financial losses, etc., instead of what can be gained in a well-calculated, strategic move. Often times, we fear making a choice towards our goals and dreams even if you have nothing to lose. Trying and not succeeding isn’t failure. Failure is never trying at all, or giving up instead of learning from it and strategizing.

Leave a Reply