As supply chains struggle under global health concerns over the spread of COVD-19, many are left wondering whether an economic recession in 2020 is imminent amid the 2,000 point plummet in the Dow, supply-chain disruptions among companies sourced in China, and weakened consumer demand in sectors such as oil and the airline industry. Data on macroeconomic indicators such as consumer spending and trade, financial markets, and underlying stress can offer a closer look at the probability of a recession. Have we hit an economic peak?

Torsten Sløk, chief economist at Deutsche Bank Securities, this yield-curve control consideration was “a sign of desperation” that current tools are not sufficient to prevent another recession.

Since 1945, the average US recessions have lasted less than one year. Economists define a recession as a decline in economic activity measured by real GDP lasting at least two consecutive quarters, accompanied by a swift decrease in employment, decrease in real income, industrial productive, and wholesale-retail sales. It begins “after the economy reaches a peak of activity and ends as the economy reaches its trough,” as defined by the National Bureau of Economic Research.

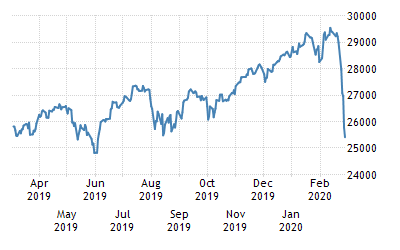

Stock Market

The volatility of stock markets aren’t a predictor of an economic downturn alone but they do offer a look into plummeting consumer demand in industries such as oil and travel that will cut into GDP in 2020. Air travel demand this year will decline for the first time since 2009 and cost airlines over $29 billion in revenue, the International Air Transport Association warned last week. Airline stocks — a target for coronavirus-related sell-off — are down approximately 21% year to date — worse than the decline of the Dow Jones Industrial Average. Companies expect to experience declines in revenue in the first quarter due to over 200,000 in already cancelled flights to and from China. The Deutsche Bank and Buckingham downgraded a number of airline stocks including American, Alaska, Delta, Spirit, JetBlue and United, believing it is likely that “COVID-19 will disrupt travel patterns beyond China” with new cases rising outside of China raising the over 81,000 number of cases.

Stocks across the board are in retreat as investors are rattled by fears of the epidemic. All 11 sectors of the S&P 500 SPX, 1.84% posted declines from February 19 through February 27. The energy sector, with an oversupply of oil, tops the list with a -17.60% price change since February 19. Oil prices are down over 4% in early trading — their lowest level in over a year and the WTI fell to $47.25 per barrel. The spread of the epidemic has surpassed the IEA’s early February predictions of decreased global oil demand in the first quarter of the year. Cciting the blow to global oil demand, Goldman Sachs told clients it is cutting its 2020 oil demand growth forecast in half to 600,000 barrels a day.

Employment

The longest economic expansion on record is now in its 11th year, and the unemployment rate remains low at 3.6%, with the economy creating 225,000 jobs in January. However, the number of jobless claims has risen in the last week. Claims for state unemployment benefits rose to 219,000 for the week ended in February 22 per the Labor Department. The four-week average of claims rose 500 to 209,750 last week.

Industrial Production: A Supply-side Disaster Can Cut Employment and Wages

American companies reliant on Chinese assembly are anticipating a 50% drop in revenue which can induce a supply-side disaster which can cut employment and wages. Companies like Apple and Amazon are vulnerable to this.

Financial Markets

Corporate earnings climbed 22.7% in 2018 following the 2017 passage of the Tax Cuts and Jobs Act, but earnings growth was 1.1% in 2019. Federal Reserve Board governor, Brainard, said the Fed would control the short-end of the yield-curve and target longer-term, buying bonds to keep it from rising above target.Torsten Sløk, chief economist at Deutsche Bank Securities, this yield-curve control consideration was “a sign of desperation” that current tools are not sufficient to prevent another recession. Yield-curve control was not even used in the 2008 financial crisis. However, two Fed officials said they are not worried about a recession in the short term, but COVD-19 is a risk to the outlook. Atlanta Fed President Raphael Bostic said he COVID-19 outbreak would likely result in a “short-time hit” for the economy.

Keynesian Tools and Monetary Policy Can’t Prevent A Recession

In the case of a COVD-19-induced recession, no level of monetary policy or demand-side economics can ameliorate it. Lower interest rates, quantitative easing, federal spending, or tax cuts can’t fix the supply-chain problem rooted in companies reliant on COVD-19 affected China. More money into consumers’ pockets won’t put more products on the shelves. The sustained labor market strength and 11-year economic growth can quickly be derailed by the disrupted global oil demand and American supply-chains in China but it is too soon to tell the full-scale impact of this epidemic.

Leave a Reply